SEPA direct debit offers businesses a streamlined solution for automating receivables collection. From its inception to its operational intricacies, understanding SEPA Direct Debit is essential for optimizing payment processes.Let’s delve into its key features and benefits to harness its full potential for your business.

It simplifies payments for businesses.It is a handy tool for automating receivables.Everything about the SEPA direct debit, received from my colleague, is easy to grasp.With its streamlined process, managing transactions becomes a breeze.

SEPA Direct Debit is a payment method for businesses.It automates receivables collection in the Eurozone.It simplifies transactions across 36 countries.SEPA Direct Debit streamlines cash management for companies.

SEPA direct debit types: SDD Core or SDD B2B

SEPA Direct Debit comes in two types: SDD Core and SDD B2B. SDD Core is available to all players, making it versatile for various transactions.On the other hand, SDD B2B is designed specifically for inter company relations, speeding up financial exchanges between businesses

Both types share common features but cater to different needs and scenarios.With SDD Core, businesses can collect payments from individuals or other companies within the SEPA zone.It is ideal for recurring bill payments or subscriptions, offering flexibility and convenience.

Meanwhile, SDD B2B focuses on enhancing business to business payments, facilitating faster and more efficient commercial transactions.Understanding the distinctions between SDD Core and SDD B2B helps businesses choose the right option for their specific requirements.

You May Lie This: APHP Messaging: How To Access It?

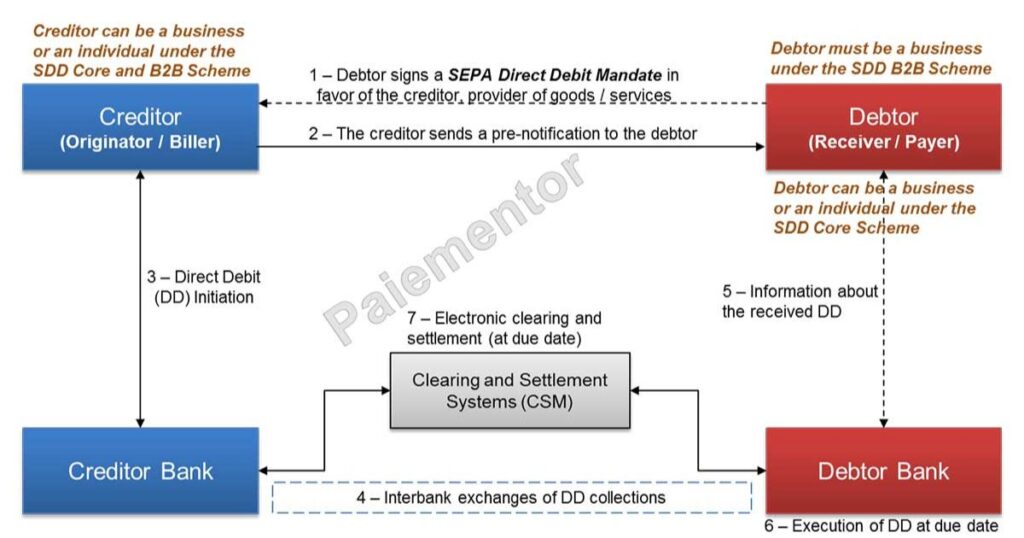

2. How SEPA direct debits work

SEPA Direct Debit comes in two types: SDD Core and SDD B2B. SDD Core is available to all players, making it versatile for various transactions.On the other hand, SDD B2B is designed specifically for inter company relations, speeding up financial exchanges between businesses.

Both types share common features but cater to different needs and scenarios.With SDD Core, businesses can collect payments from individuals or other companies within the SEPA zone.It is ideal for recurring bill payments or subscriptions, offering flexibility and convenience.

Meanwhile, SDD B2B focuses on enhancing business to business payments, facilitating faster and more efficient commercial transactions.Understanding the distinctions between SDD Core and SDD B2B helps businesses choose the right option for their specific requirements.

You May Like This: The Latest Italian Football News, Transfers And More

Features of SEPA Direct Debit (SDD)

SEPA Direct Debit simplifies payment processing for businesses by allowing them to debit euro amounts from debtor accounts within the SEPA zone.It spans 36 countries, including EU members, EFTA states and others like Monaco and Andorra.

Whether for one time or recurring transactions, SEPA Direct Debit offers a seamless way to automate collections.Businesses must adhere to specific formalities and execution rules to ensure compliance and smooth operation.

Specific features of SDD B2B direct debits

SDD B2B direct debits cater specifically to business-to-business transactions, facilitating faster financial exchanges and improving commercial relations.Unlike SDD Core, B2B debits allow for presentations up to one business day before the due date.

B2B transactions are considered authorized payments, limiting refund requests except in cases of fraud or error.These unique features make SDD B2B an ideal choice for companies seeking efficient and secure payment solutions within the SEPA zone.

Setting up SEPA SDD Core direct debits

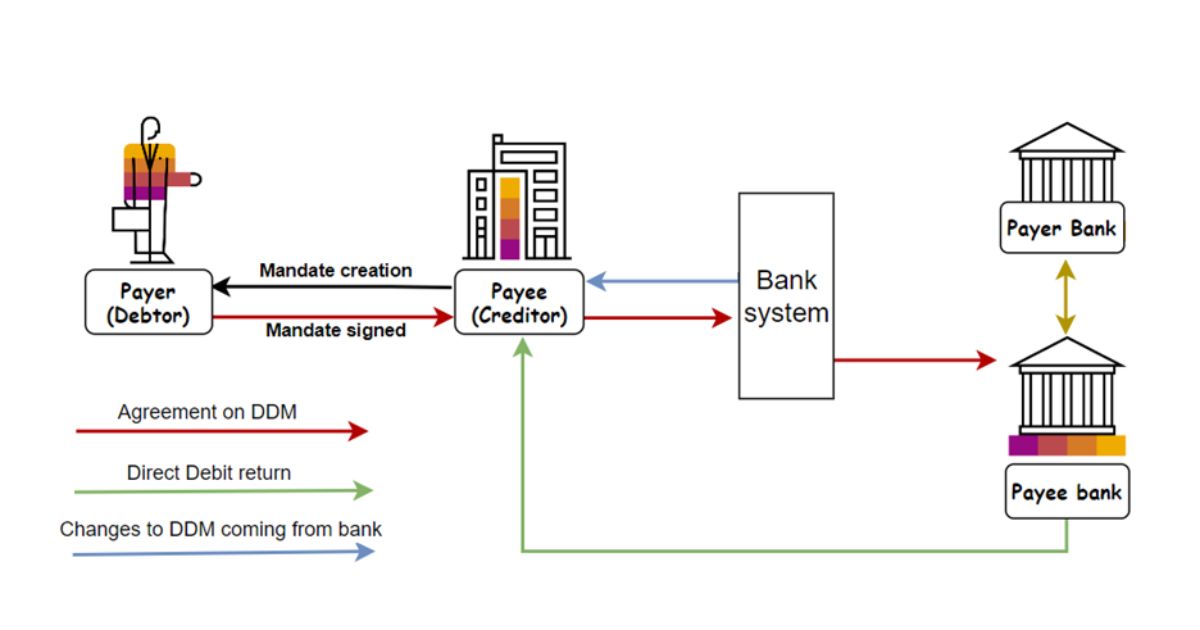

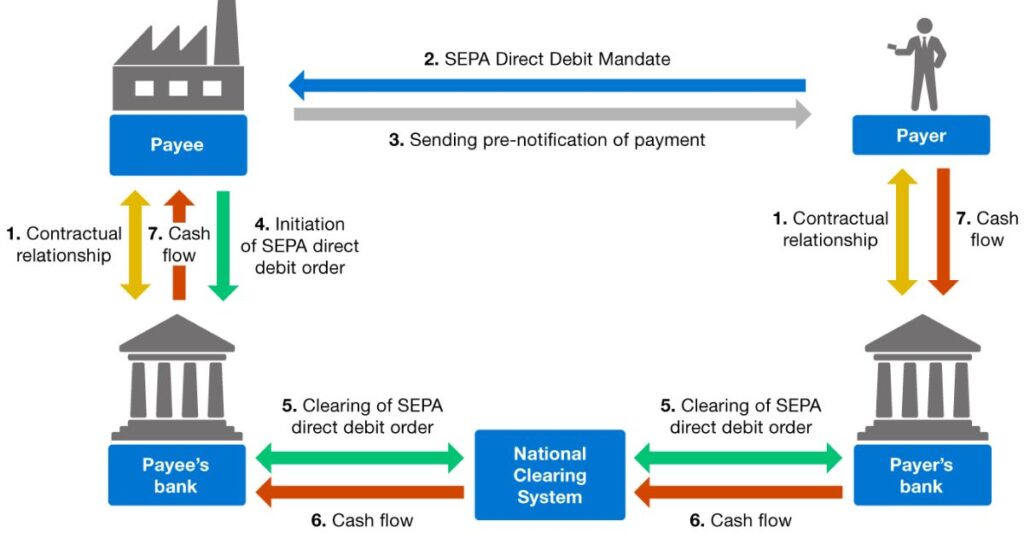

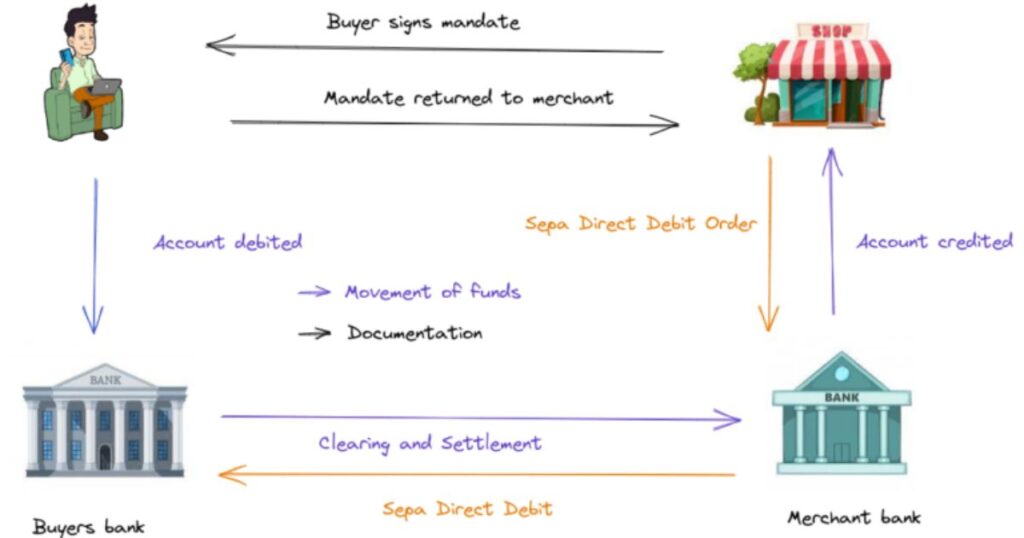

To initiate SEPA SDD Core direct debits, the creditor sends a mandate to the debtor, who then provides their contact details, IBAN and BIC code.Once completed, the debtor returns the signed mandate to the creditor, who stores it securely.

About 14 days before the collection date, the creditor informs the debtor of the transaction details.Subsequently, the creditor issues the direct debit order to their bank, which then debits the debtor’s account and credits the creditor’s account upon completion.

Setting up SEPA SDD B2B direct debits

Setting up SEPA SDD B2B direct debits involves a similar process, with slight variations.The creditor sends the mandate to the debtor, who provides their contact information and banking details.Unlike SDD Core, in B2B transactions, the debtor signs two copies of the mandate one for the creditor and one for their own bank.

The creditor informs the debtor of the transaction details about 14 days before the due date.Finally, the creditor’s bank forwards the direct debit order to the relevant parties for processing, resulting in the debiting of the debtor’s account and crediting of the creditor’s account.

Period of validity of the SEPA direct debit mandate

The validity period of a SEPA direct debit mandate varies based on its nature.For single transactions, the mandate remains valid only for that particular payment.However, for recurring transactions, the mandate remains in effect until the debtor revokes it.

If no direct debit is initiated within 36 months, the mandate automatically lapses.This flexibility allows debtors to manage their mandates according to their payment preferences and obligations.

Canceling a SEPA Direct Debit

If you need to cancel a SEPA Direct Debit, you have options. For authorized direct debits, like SEPA Core, you can request reimbursement within 8 weeks of the debit date.However, for SEPA B2B, refunds are limited, usually only possible in cases of fraud or error.It’s essential to act promptly and follow the necessary steps to cancel a SEPA Direct Debit effectively.

Terminating a SEPA Direct Debit Mandate

You have the right to terminate your SEPA Direct Debit mandate at any time.To do so, you can contact both your creditor and your bank.Simply write a registered letter to your creditor, indicating your decision to cancel the mandate.

Informing your bank can serve as a precautionary measure. By taking these steps, you can cease any further direct debits from your account smoothly and efficiently.

3. The SEPA mandate in detail

Definition of the SEPA Direct Debit mandate

The SEPA Direct Debit mandate is a crucial authorization document that underpins the payment process. It serves as permission for a creditor to debit funds from a debtor’s account.This mandate includes essential information such as the creditor’s identity, SEPA Creditor Identifier (SCI), Unique Mandate Reference (UMR), debtor’s details, IBAN, and BIC code.

The mandate outlines the nature of the debit, whether recurring or one time and requires the debtor’s signature.Without a valid mandate, initiating SEPA Direct Debits is not possible, emphasizing its significance in facilitating seamless transactions within the SEPA zone.

Information required for debiting

- Creditor’s identity

- SEPA Creditor Identifier (SCI)

- Unique Mandate Reference (UMR)

- Debtor’s identity

- Debtor’s IBAN and BIC code

- Type of debit (recurring or one-time)

- Nature of the mandate (SDD Core or SDD B2B)

- Date of signature of the mandate

- Debtor’s signature

4. Main differences between SEPA Core and B2B direct debits

The main differences between SEPA Core and B2B direct debits are crucial for businesses to understand.SEPA Core Direct Debit is for both individuals and companies, whereas SEPA B2B Direct Debit is exclusively for business transactions.

The handling of mandates differs between the two. In SEPA Core, the debtor sends the mandate solely to the creditor, while in B2B, the debtor sends copies to both the creditor and their own bank.

Dispute resolution and refund processes vary between SEPA Core and B2B direct debits.With SEPA Core, debtors can contest authorized direct debits within eight weeks, while with B2B, such disputes must occur within 13 months.Understanding these distinctions is essential for businesses to choose the most suitable direct debit scheme for their operations.

Focus on the SEPA creditor identifier, or SCI

- The SEPA Creditor Identifier (SCI) is a unique reference for creditors.

- It is mandatory for initiating SEPA direct debits.

- The SCI comprises country codes, control numbers and activity codes.

- Treezor assists in obtaining a customizable SCI for businesses.

- SCI ensures smooth processing and identification of direct debit mandates.

FAQ’s

How does SEPA direct debit work?

SEPA direct debit works by allowing creditors to automatically debit funds from debtors’ accounts within the SEPA zone.

Who is the provider of SEPA direct debit?

Treezor is the provider of SEPA Direct Debit.

What are the SEPA payment details?

SEPA payment details include the SEPA Creditor Identifier (SCI), Unique Mandate Reference (UMR) and debtor’s IBAN and BIC code.

How do I accept a SEPA payment?

To accept a SEPA payment, you need to have a SEPA Direct Debit scheme in place and obtain the necessary authorization from the payer.

Final Thought

In conclusion, SEPA Direct Debit is a powerful tool for businesses. It streamlines payment processes across the Eurozone, enhancing efficiency.By embracing SEPA Direct Debit, businesses can optimize cash management and foster customer loyalty.

But the question remains: How can your business maximize its benefits?Understanding its nuances is key.With expert guidance, you can navigate the complexities of modern payment infrastructure confidently.Unlock the power of SEPA Direct Debit today and propel your business forward with seamless transactions and enhanced financial management.